FINANCIAL PROJECTIONS

This section outlines the financial projections for Blix Tavern's launch and ongoing operations in Copenhagen. The projections cover estimated startup costs, operating expenses, revenue forecasts, and potential funding sources. These projections are designed to offer a clear financial roadmap for the establishment’s first three years of operation, demonstrating its potential for profitability while ensuring sustainable growth.

1. Startup Costs

The startup costs for Blix Tavern in Copenhagen will cover initial expenses related to the establishment of the business, including location setup, permits, equipment, marketing, and staffing. The total estimated startup investment is broken down as follows:

Note: The above figures are based on estimates for a mid-to-high-end location in Copenhagen, factoring in typical costs for renovations, licensing, and initial operational setup.

2. Operating Expenses (Annual)

Operating expenses are essential to maintaining day-to-day operations at Blix Tavern. These costs will be recurring and will need to be covered by the revenue generated each month. Below is an estimate of the annual operating expenses for the first year.

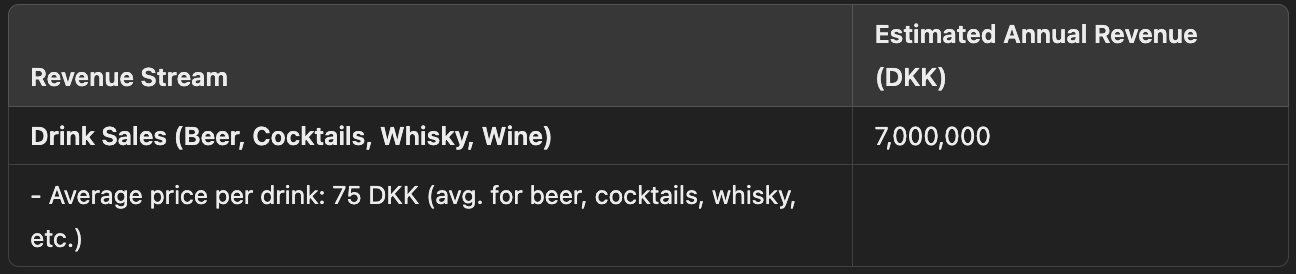

3. Revenue Projections (Annual)

Revenue will primarily come from the sale of craft beer, premium whiskies, cocktails, wine, food, and cigars. We anticipate that Blix Tavern will generate significant revenue, particularly in the first two years as the venue builds brand recognition and attracts both local residents and tourists.

Estimated 250 drinks sold per day, with an average spend of 300 DKK per customer. (5 days/week operation) | 7,000,000 | | Cigar Sales | 1,200,000 | | - Average cigar sale: 150 DKK per cigar

Estimated 100 cigars sold per month. | 1,200,000 | | Food Sales (If applicable) | 2,000,000 | | - If Blix Tavern offers light bites or tapas-style food, we estimate food sales at approximately 150,000/month. | 2,000,000 | | Event and Private Booking Fees | 500,000 | | - Estimated revenue from private events, tastings, and corporate bookings. | 500,000 | | Total Annual Revenue | 10,700,000 |

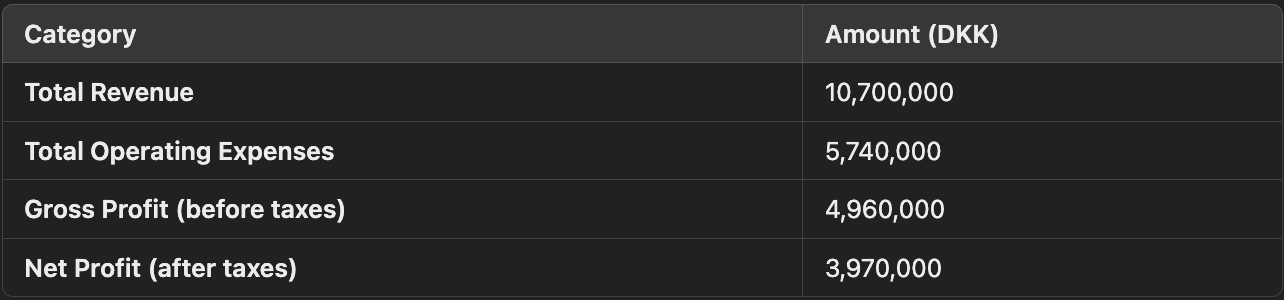

4. Profit and Loss Summary (Year 1)

Based on the estimated revenue and operating expenses, the financial outlook for Blix Tavern in its first year is as follows:

Note: The net profit in the first year is estimated to be higher due to initial capital investment in marketing and branding, expected to generate strong revenue growth in Year 1.

5. Financing and Funding Options

To cover the startup costs and initial operating expenses, Blix Tavern will explore a combination of the following funding options:

Equity Investment

Blix Tavern will consider bringing in private investors or venture capital firms specializing in hospitality and luxury brands to raise the necessary funds. The equity offered will depend on the total amount of capital required and the investors’ terms.

Bank Loans or Business Financing

A traditional bank loan or line of credit could be secured to finance a portion of the startup costs. This loan could be repaid over a period of 3-5 years, depending on the agreed-upon terms and interest rates. It is recommended to approach local banks in Copenhagen for favorable rates and repayment terms for business owners with a well-structured business plan.

Crowdfunding or Peer-to-Peer Lending

Given the unique concept of Blix Tavern, we could consider a crowdfunding campaign targeting customers who are passionate about African culture, fine beverages, and premium experiences. Peer-to-peer lending platforms may also offer attractive loan terms for small businesses.

Owner’s Capital and Personal Investment

The business founders may also contribute a portion of the capital required through personal savings or funds from other business ventures.

Conclusion

Blix Tavern is positioned to become a high-end, profitable venue in Copenhagen with strong revenue potential, particularly from drink and cigar sales, as well as private events. With a clear financial roadmap and projected profitability, the venture offers a compelling opportunity for investors and stakeholders. The proposed financing options, coupled with the revenue projections and operating expense estimates, highlight a sustainable business model capable of generating significant returns.